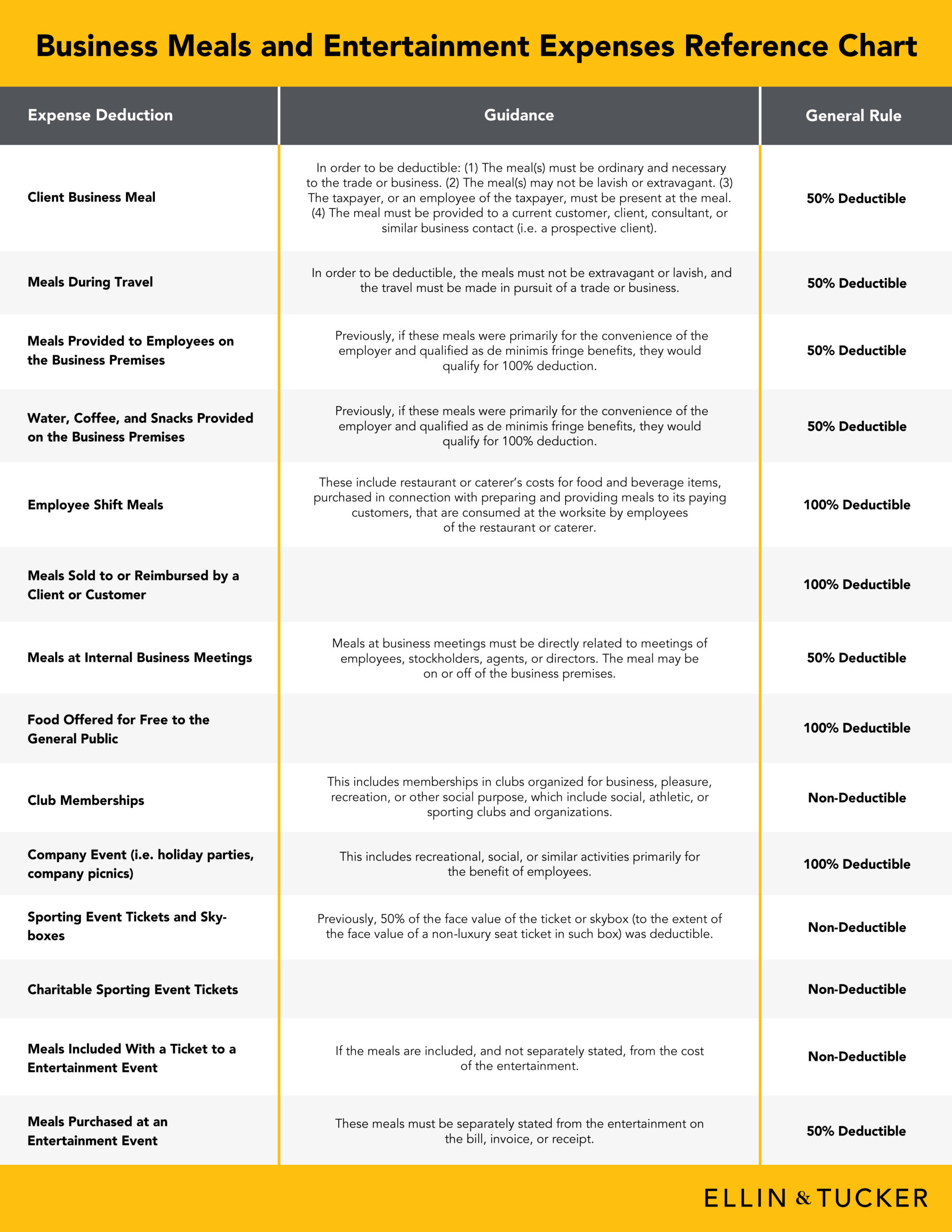

Is Entertainment Deductible In 2025. You can deduct part of the cost of entertaining clients. The golden rule here is that you can deduct expenses for meals and entertainment when they're incurred primarily for the purpose of earning business.

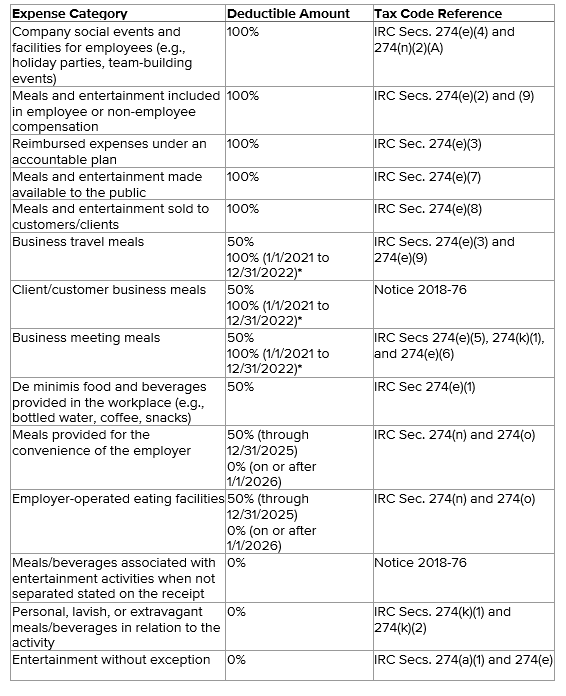

On december 27, 2025, the u.s government signed the consolidated appropriations act to make further changes to meal and entertainment. According to the canada revenue agency, the maximum you can deduct for food, beverage, and entertainment expenses is 50% percent of the.

One of the biggest changes is that deductions are no longer allowed for entertainment expenses, except for certain employee events.

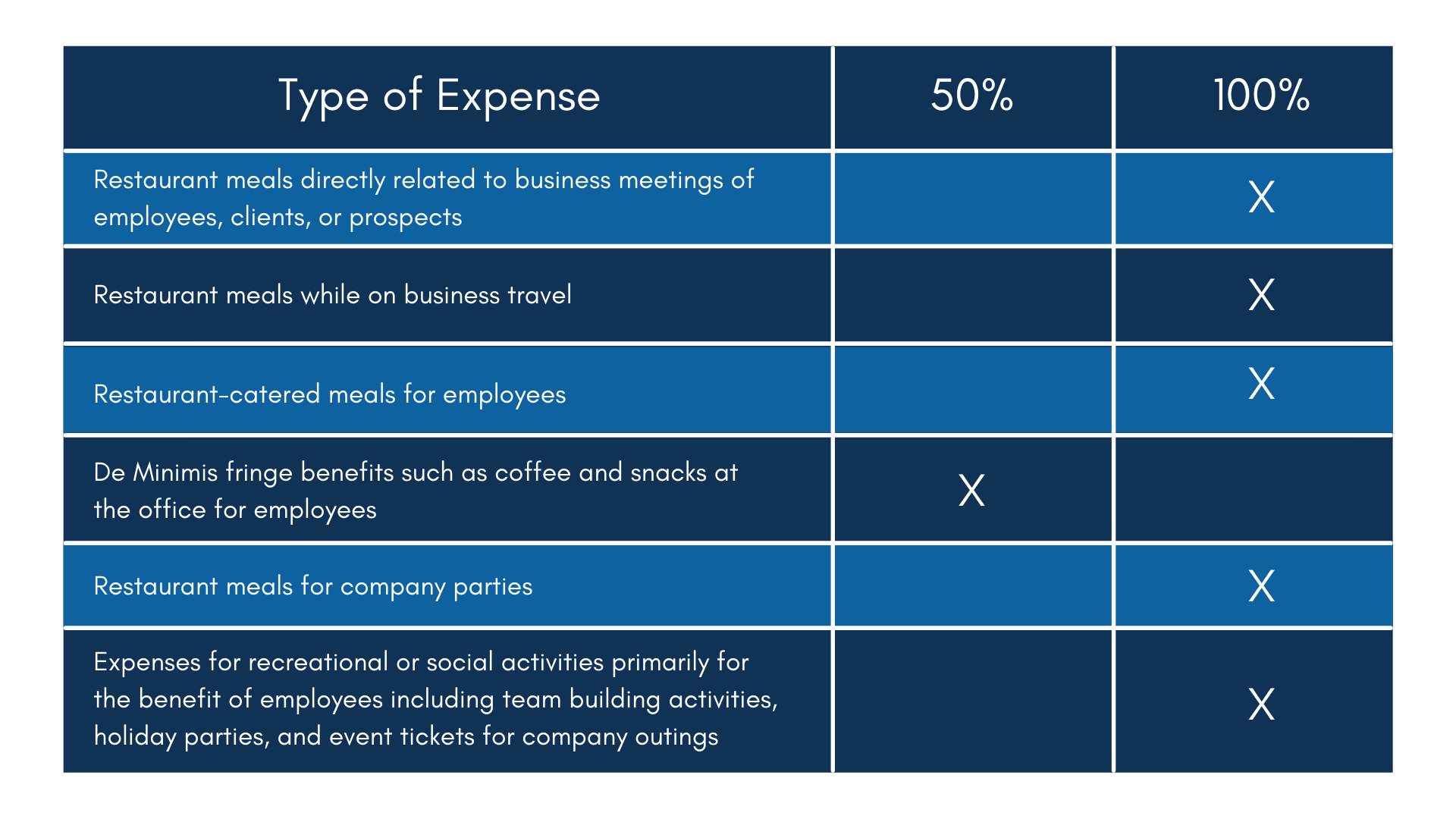

Expanded meals and entertainment expense rules allow for increased, According to the canada revenue agency, the maximum you can deduct for food, beverage, and entertainment expenses is 50% percent of the. Here are some common examples of 100% deductible entertainment and meal expenses:

Meal and Entertainment Deductions for 20232024, One of the biggest changes is that deductions are no longer allowed for entertainment expenses, except for certain employee events. Following several failed attempts over five months of israel’s devastating war in gaza, the united nations security council on monday finally passed a.

Check, Please Deductions for Business Meals and Entertainment Expenses, The tax landscape is forever changing, and as we look ahead to 2025, there are speculations about potential changes in tax. Following several failed attempts over five months of israel’s devastating war in gaza, the united nations security council on monday finally passed a.

What Is The Standard Deduction For 2025 Grata Brittaney, Here are some common examples of 100% deductible entertainment and meal expenses: This includes expenses for depreciation and operating.

Tax Treatment for Entertainment Expenses What Is Tax Deductible?, I'm a celebrity's frankie muniz exposes brutal reality of child stardom. According to pedestrian, one of this year’s male celebrities is being paid $90,000.

Meals & Entertainment Deductions for 2025 & 2025, The four tax myths to be aware of in 2025. According to pedestrian, one of this year’s male celebrities is being paid $90,000.

Meals & Entertainment Deductions What’s New for 2025 & 2025 Beaird, This includes expenses for depreciation and operating. The four tax myths to be aware of in 2025.

Meals, Entertainment, and Commuting Changes Under Tax Reform Alloy, This article is tax professional approved. This change was met with significant resistance.

Understanding Business Meal and Entertainment Deduction Rules Selden Fox, I'm a celebrity's frankie muniz exposes brutal reality of child stardom. On december 27, 2025, the u.s government signed the consolidated appropriations act to make further changes to meal and entertainment.

Meals & Entertainment Deduction 2025 5 MustKnow Tips FlyFin, I'm a celebrity's frankie muniz exposes brutal reality of child stardom. This includes expenses for depreciation and operating.